- China’s Foreign Policy under Presid...

- The Contexts of and Roads towards t...

- Seeking for the International Relat...

- Three Features in China’s Diplomati...

- Middle Eastern countries see role f...

- China strives to become a construct...

- In Pole Position

- 'Afghan-led, Afghan-owned' is way f...

- Wooing Bangladesh to Quad against C...

- China's top internet regulator mull...

- The Establishment of the Informal M...

- China’s Economic Initiatives in th...

- Perspective from China’s Internatio...

- Four Impacts from the China-Nordic ...

- Commentary on The U. S. Arctic Coun...

- Opportunities and Challenges of Joi...

- Identifying and Addressing Major Is...

- Opportunities and Challenges of Joi...

- Evolution of the Global Climate Gov...

- China’s Energy Security and Sino-US...

- China-U.S. Cyber-Nuclear C3 Stabil...

- Leading the Global Race to Zero Emi...

- Lies and Truth About Data Security—...

- Biden’s Korean Peninsula Policy: A ...

- Competition without Catastrophe : A...

- China's Global Strategy(2013-2023)

- Co-exploring and Co-evolving:Constr...

- 2013 Annual report

- The Future of U.S.-China Relations ...

- “The Middle East at the Strategic C...

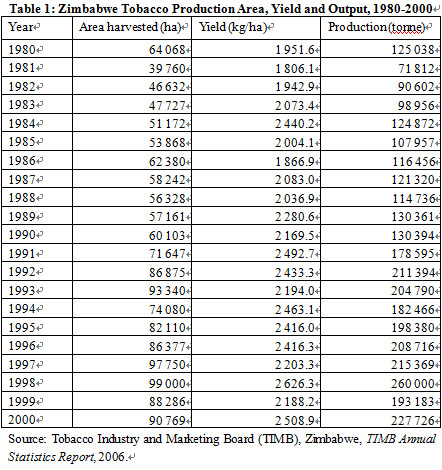

Zimbabwe’s economy is predominantly agro-based therefore agriculture plays a critical role in the development of the nation. As such, the Zimbabwe Ministry of Lands notes that “of the country’s land area of 39.6 million hectares, 33 million hectares are reserved for agriculture.”[①] Table 1 summarises Zimbabwe’s tobacco production area, yield and output from the year 1980 to the year 2000. It shows the increase in the hectares of land under tobacco accompanied by a corresponding increase in yields harvested by farmers. At independence, the Government of Zimbabwe (GoZ) was able to take advantage of tobacco export trade that had been developed under the colonial regime and steadily increased tobacco production. Despite fluctuations in yields, tobacco farming in Zimbabwe has steadily grown and contributed significantly to the nation’s development as shown in Table 1.

Anseeuw et al states that “Tobacco is Zimbabwe’s most valuable agricultural commodity, accounting for about 26% of agricultural GDP and 61% of agricultural exports”.[②] Once the world’s second largest flue-cured tobacco exporter in 2000, Zimbabwe is now the world’s sixth-largest exporter, ranking behind Brazil, India, the United States, Argentina and Tanzania.” Indeed tobacco is an export crop that contributes significantly to the country’s revenue and her capacity to capitalise on tobacco production has made her a significant player in the global tobacco industry. The potential of the tobacco industry in Zimbabwe is worth investing in by both foreign entities and government as it contributed significantly towards national income. Sukume and Guveya estimate that “Approximately 98% of tobacco produced in Zimbabwe is exported, to over 80 countries. The remaining 2% is processed locally by four cigarette-manufacturing plants, of which three produce for export.”[③] While it is positive that the bulk of tobacco produced is exported, there is need for Zimbabwe to intensify its processing of the crop and establish her own competitive quality brands of cigarettes on the global market.

According to Food and Agriculture Organization of the United Nations (FAO), “Tobacco also plays a central role especially in the northern regions of the country. Most commercial farm strategies begin with, and revolve around, tobacco. It offers smallholder growers a unique opportunity for exceptionally high producer profits and excellent rates of return. Thus, tobacco production has provided an economic base for farmers to develop other production opportunities.”[④] While other crops such as maize and cotton are financially beneficial and grown in rotation with tobacco, the latter has proved to be more profitable than other crops in Zimbabwe and enabled farmers to diversify their production.

Tobacco farming in Zimbabwe has also provided employment for communities living in the area of tobacco farms. This is both on long-term and short-term basis. FAO states that “It was estimated that about 170 000 workers were engaged in tobacco production directly in 1998, in which large commercial tobacco farms hired about 117 000 long-term employees while 55 000 smallholder tobacco farmers operated largely on family labour. There were about 30 000 workers involved in tobacco research, marketing, service and manufacturing. In addition, short-term hirings by the large commercial farms and smallholder farms involved around 100 000 workers. Thus, full-time employment directly and indirectly would be around 250 000, roughly equal to 5 percent of Zimbabwe’s total labour force and perhaps 25 percent of formal employment.”[⑤] Given Zimbabwe’s high unemployment rate, the tobacco sector is of assistance in providing employment in the formal, casual, full-time and contract labour force.

In an interview with the researchers, officials at a certain tobacco auction floor expressed satisfaction over the price tobacco was fetching at the auction floor which reached a ceiling figure of $4,99/kg in the 2012 selling season and which was also maintained in the 2013 season. He further noted that the quality of life of tobacco farmers had increased considerably due to the fair prices their tobacco was fetching on the auction floor. While acknowledging the benefits of the country’s land reform program, he expressed his belief that the Government of Zimbabwe still has a pivotal role to support tobacco farmers if they are to fully maximize on their potential. However, in contrast to the sentiments of the officials, tobacco farmers interviewed on the tobacco auction floor indicated that there was an unfair pricing regime as they believed large scale commercial farmers were been offered higher prices for their crop as compared to small scale tobacco farmers (phase 1) despite both of them having delivered tobacco of the same quality. The farmers further expressed concern over Governments directive prohibiting them from using wood in their barns. This means that they will have to resort to coal, a resource which they indicated they could not afford and would contribute towards them opting for contract farming which provides them with support.

According to Solidar, a NGO for advancing social justice in Europe and worldwide, “Zimbabwe’s major export crop to China is tobacco and yet its major import from the same country is also tobacco. This is due to Zimbabwe leasing land for tobacco farming to the Chinese and whatever is taken out of the country is considered among the exports in raw form. Zimbabwe in turn imports processed tobacco for its domestic market.”[⑥] This pattern of relationship is similar to one that the dependency theorists described, where one country provides raw materials to another which processes them only to sell them back to the suppliers of raw materials as finished goods. In a presentation, Deputy Managing Director of Tianze, Cai Bing stated that “China started using Zimbabwe leaf since the 1980s.[⑦] Its appealing characteristics are that the leaf is of good maturity, uniform chemical composition as well as contains ample flavour and is usually open and rich in oil. Its flavour is very much needed by Chinese cigarettes. There is an increasing demand for Zimbabwean tobacco as it has become indispensable for top Chinese cigarette manufacturing.” Zimbabwe tobacco is appreciated in China and is used to flavour Chinese cigarettes. The fact that it is of good quality and in demand should be taken into account and considered a comparative advantage by Zimbabwe when it negotiates prices for its export tobacco.

Schwersensky observes that “The crop has generally been regarded as Zimbabwe’s ‘golden leaf’ because of its historical status as the country’s highest foreign currency earner. In 2005, the two countries signed an agreement that would see the expanded tobacco fields for China to 2500 hectares of land and 10 000 more hectares were offered in a separate agreement the following year.”[⑧] With these agreements, China has become Zimbabwe’s largest tobacco consumer with the crop attracting huge Chinese investments into the agricultural sector.

The Zimbabwe Herald reported that “In 2007, the Chinese government extended a credit facility of US$200 million in support of Zimbabwe’s agriculture. The facility was mainly used to acquire farming equipment from China which included 1000 tractors, and an assortment of combine harvesters, irrigation pumps, disc harrows and planters among others.”[⑨] This also saw the extension of land given for tobacco production in the country. In August 2007, as noted by Matahwa that “Approximately 110 000 hectares in the areas surrounding Harare are committed to growing tobacco.” Tobacco farming in Zimbabwe has benefited from credit facilities from China and this is especially useful in light of the sanctions imposed on Zimbabwe. These lines of credit have ensured agricultural production is sustained and expanded.[⑩]

Apart from supporting farmers to grow tobacco, China has also proven to be the major destination of Zimbabwe’s export tobacco. Statistics availed to The Herald of 7 June 2012 by TIMB indicated that

As at June 1, China was the leading consumer of local tobacco followed by South Africa. China has so far imported 3.9 million kg of the flue-cured tobacco worth US$26, 5 million at an average price of US$6, 79 per kg. South Africa has so far bought 2, 6 million kg of flue-cured tobacco worth US$8, 5 million at an average price of $3, 22 a kg. Indonesia bought 2. 6 million kg of the golden leaf valued at US$14 million while UK imported 2. 3 million kg worth US$11.8 million and Mauritius got 2 million kg valued at US$3. 6 million.[11]

To this end it can be noted that China is a leading partner in tobacco trade with Zimbabwe through her support of local tobacco farmers and purchase of the crop.

II. Zimbabwe-China Tobacco Contract Farming

Sukume and Guveya submits that “Traditionally, tobacco was marketed through an auction marketing system overseen by the TIMB. However, in 2003 a policy decision was made to transform the tobacco marketing system from auction sales to a dual system that involves the adjacent operation of contract growing/marketing and auctions.” [12] The rationale behind this was to increase production of the crop with the support from contractors.

Most of the tobacco trade between China and Zimbabwe takes place under the banner of contract farming arrangements. According to FAO, “Contract farming can be defined as agricultural production carried out according to an agreement between a buyer and farmers, which establishes conditions for the production and marketing of a farm product or products.”[13] TIMB forwards that “contract farming which was introduced in 2004 following institutional challenges for banks to finance growers helped to sustain the crop.”[14] The point of departure in making a case for the impact and implications of Chinese involvement in Zimbabwe’s tobacco sector is that contract farming has boosted the tobacco sector at a time when the country heavily needed support in relation to its foreign and domestic policies.

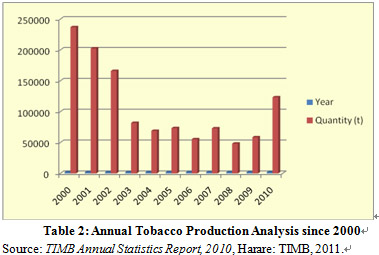

TIMB reports that during the years 2001-2011, tobacco production took a dip from a high of 236 497 tonnes in 2000 to a low of 48 225 tonnes in 2008 which however, steadily grew to about 123 407 tonnes by 2010. Factors that led to the dip in production were an erratic rainfall pattern during the year 2002, lack of requisite knowledge by the newly resettled farmers on tobacco farming and sanctions imposed on Zimbabwe by the EU and the USA which had an adverse effect on the agriculture sector. In 2005 to 2006 there was a slight increase in tobacco production as a result of the mechanisation programme and the provision of subsidised diesel by the government to the farmers. Economic stability occasioned by the dollarisation of the economy as well as increased funding of tobacco farmers by Chinese firms resulted in the higher production yields. Figure 1, gives a snap shot comparative of the total tobacco production in Zimbabwe between the years 2000 to 2010.

The formation of the inclusive government in September 2008 created a stable political environment which contributed towards strengthening investor confidence in Zimbabwe. This was coupled with the adoption of a multicurrency system which facilitated economic stability. The rise of tobacco prices encouraged more farmers to engage in tobacco farming and resulted in a rise in the tonnage yielded. The increase in tobacco buyers due to contact sales that complimented auction sales also increased the amount of tobacco produced in the year 2010. According to Tianze reports, “China has helped increase the price of tobacco bought from farmers as it is not necessarily a marketer but direct buyer through Tianze and GDI, who in turn supply the tobacco directly to the STMA in China. Global demand of tobacco contributed to the rise in prices.”[15] Attractive prices of tobacco led to an increase of tobacco production and trade to China as well.

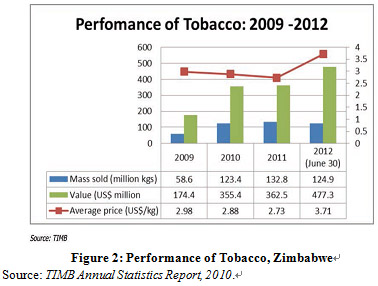

Tabulated in Figure 2 is the cumulative range of tobacco prices between 2009 and 2012. The firming of prices to an all-time average high of $3.71 was attributed to increased contract farming, quality leaf as well as firming international average prices which benefitted local farmers. According to the 2012 Mid-Term Fiscal Review Policy Statement, “prices for flue cured tobacco at the auction floors were generally higher compared to the previous period due to adverse weather conditions experienced in Brazil and the USA, which reduced the 2012 global output of the golden leaf by about 200 million kgs.[16] The major export destinations were China, UK, South Africa, Indonesia, UAE, Mauritius and Russia among others.”

Increased tobacco production and trade with China necessitated a rise in the GDP of the country which heavily relies on the agriculture and mining sectors. According to RBZ research, tobacco production has consistently made an important contribution to GDP and to export revenue since 2000, despite problems of low productivity at the onset of the Fast Track Land Reform Programme and plays a major role in the national economy. “The crop has consistently averaged more than 50 percent of agricultural exports, 30 percent of total exports and nearly 10 percent of GDP.” The high performance of tobacco has been attributed in part to Chinese contract farming.

Chinese contract farming is based on a number of agreements that are concluded between the investor and the farmer. These agreements place obligations on both the farmer and the purchaser. FAO explains that in drawing up a contract “Typically, the farmer agrees to provide agreed quantities of a specific agricultural product. These should meet the quality standards of the purchaser and be supplied at the time determined by the purchaser. In turn, the buyer commits to purchasing the product and, in some cases, to supporting production through, for example, the supply of farm inputs, land preparation and the provision of technical advice.”[17] The relationship can be described as a mutually beneficial one and it is in the best interests of both parties to fulfill their end of the bargain if the contract is going to be profitable. The foregoing definition of contract farming and the agreements reached have relatively positive implications on Zimbabwe while factoring in risks that are expected in any business transaction. An assessment of the implications of China-Zimbabwe relations on tobacco trade shall now be made by analysing the benefits and challenges of tobacco contract farming.

One of the benefits of contact farming is that farmers are provided with inputs and production services. Eaton and Shepard state that “Many contractual arrangements involve considerable production support in addition to the supply of basic inputs such as seed and fertilizer. Sponsors may also provide land preparation, field cultivation and harvesting as well as free training and extension services.”[18] Such was the arrangement in 2011 when farmers in Mashonaland East province benefited from a twinning programme with Hubei Province of China in which the latter contracted the farmers and later bought their produce. Contractors also funded the farmers operations up to harvesting prior to their buying the produce. As such, the implications are that tobacco farmers have inputs and support from their contractors without whom they (farmers) would have a curtailed farming capacity.

The Herald reported that under this twinning programme, “China set up a tobacco planting project in the area which has seen an improvement in quality and yields produced. Tobacco from this project has been earning top prices at the auction floors this season.”[19] Contractors support goes beyond technical and inputs benefits. Such support implies that the farmers’ yields are increased in quantity and quality reaping considerable financial profits for the farmer. On the issue of quality, Manyeruke notes that “Zimbabwe’s products, just like any products from developing countries face steep Technical Barriers to Trade (TBT) which include Sanitary and Phytosanitary measures.”[20] Contract farming, through skills and technical support helps to ensure that Zimbabwe tobacco meets world-class market standards and is competitive on the global market. The implication is that contract farming raises the standard of production while establishing Zimbabwe tobacco as a quality brand on the world market. Dicken (1986:363) (http://www.fao.org) is of the view that:

New techniques are often required to upgrade agricultural commodities for markets that demand high quality standards. New production techniques are often necessary to increase productivity as well as to ensure that the commodity meets market demands. Nevertheless, the introduction of new technology will not be successful unless it is initiated within a well-managed and structured farming operation. Private agribusiness will usually offer technology more diligently than government agricultural extension services because it has a direct economic interest in improving farmers’ production.[21]

Improved volumes and quality of yields as well as new techniques must be accompanied by new technologies. As such, technological transfer is another benefit for Zimbabwe’s contract farmers. Given China’s high levels of technological advancement, Zimbabwe is in a position to obtain efficient agricultural equipment. However there is need for appropriate and quality technological transfer that takes into consideration the context in which it will be used.

Technological transfer is more efficient if it is complimented by skills transfer that will utilise new technologies while reconciling them with traditional methods. Eaton and Shepard state that:

The skills the farmer learns through contract farming may include record keeping, the efficient use of farm resources, improved methods of applying chemicals and fertilizers, knowledge of the importance of quality and the characteristics and demands of export markets. Farmers can gain experience in carrying out field activities following a strict timetable imposed by the extension service. In addition, spillover effects from contract farming activities could lead to investment in market infrastructure and human capital, thus improving the productivity of other farm activities. Farmers often apply techniques introduced by management (ridging, fertilizing, transplanting, pest control, etc.) to other cash and subsistence crops.[22]

Skills transfer therefore involves not just a practical exchange of farming methods but of technical know-how and knowledge of other markets requirements and a systematic documented approach to tobacco farming. To this end, contract farming is a major step in the establishment of synergies in other sectors.

Contract farming also implies that farmers can at times be offered a higher price than they would have been offered at auction. Commenting on tobacco prices in the 2012 selling season, CFM News reported that;

Out of the 13 tobacco contracting companies which are operating this season in Zimbabwe, Tianze Tobacco Company, which contracts more than 250 growers, continues to lead in both the seasonal and daily average prices. Tianze, which has to date bought more than 4.2 million kg of the leaf valued at US$17.5 million, is offering the highest seasonal average price of US$4.14 per kg and a daily average price of US$4.61. With an average price of US$4.05, Northern Tobacco Company emerges as the second highest buyer, while Tribac, whose prices are pegged at US$3.92, are the third. The Tobacco Industry and Marketing Board (TIMB) this season licensed 13 contract companies. The contract system now accounts for 34.2 million kg of tobacco valued at US$132 million.[23]

Accordingly, the Zimbabwean government states that the “The bulk of the tobacco has been sold under the contract sales. So far, 452 615 kg of the golden leaf have been sold under contract while 330 825 kg were sold through auction.” In relation to the 2012 selling period, the Commercial Farmers Union (CFU) said that “at least 60% of the crop would be sold under contract with the remainder going on the block in auction sales.”[24] It can thus be argued that the prospects of guaranteed markets and attractive prices for their tobacco imply that more farmers will opt for the contract farming over the auction system in Zimbabwe and that the number of tobacco farmers will increase.

In addition Zimbabwe farmers also benefit through guaranteed and fixed pricing structures in contract farming. In a free market economy, farmers sell their crops on the open market and prices are subject to market forces and as such uncertainty prevails. Under contract farming, however, Eaton and Shepard note “Frequently, sponsors indicate in advance the price(s) to be paid and these are specified in the agreement. On the other hand, some contracts are not based on fixed prices but are related to the market prices at the time of delivery.”[25] In these instances, the contracted farmer is clearly dependent on market volatility. In the case of a contract that specifies the amount to be paid by the contractor, the farmer is protected from the uncertainty of the price fluctuations on the open market.

Zimbabwe tobacco farmers further benefit from access to reliable markets as contract farming provides them with market guarantees. Eaton and Shepard note that “They do not have to search for and negotiate with local and international buyers, and project sponsors usually organize transport for their crops, normally from the farmgate.”[26] This is of benefit to small-scale tobacco farmers who may not have the ability to access ready markets or negotiate sales and logistics profitably. Contract farming in this case implies the farmer focuses on his/her expertise and leaves other technicalities to those who know best how to handle them.

Another implication of Chinese engagement with Zimbabwe in the tobacco sector is that farmers have access credit. This is of advantage to small-scale farmers who experience difficulties in obtaining credit for production inputs. Contract farming is also an advantage in that it tends to provide farmers with access to some form of credit to finance production inputs. Examples of extension of lines of credit are the 2011 unveiling of nearly $700 million to Zimbabwe. The loans included $342 million for agriculture equipment availed by China’s Export-Import Bank. In 2001, it was reported that the Ambassador of China, Hou Qingru donated to Zimbabwe on behalf of his government agricultural equipment worth US$241,000 in order to show support for the land reform program. Subsequently, the Chinese government made available several credit lines in further support of agriculture. The implication is that farmers are able to capitalise or recapitalise their operations.

Besides direct investments in farming, Chinese investments in various sectors of Zimbabwe have aided the farming sector. For example, Manyeruke notes that

Zimbabwe’s economic development is set back by dilapidated infrastructure. Domestic power generation, which currently stands at around 1200 MW, against a national demand of 2 200 MW and installed capacity of 1 960 MW, remains a major constraint to the operations of all sectors of the economy. In 2000, China supplied equipment for the utilization of solar energy. Under the new agreement of cooperation in the energy sector, in November 2004, Zimbabwe Electricity Supply Authority (ZESA) received equipment mostly transformers worth US$110million.[27]

With limited power supply, farmers are unable to tend to their crops as required and this affects the quality and quantity of their yields. High tariffs charged by ZESA also result in defaulting farmers been disconnected. Investments such as the above-stated one help to meet the electric power demand required by farmers and proffers alternatives that are more affordable in the form of solar energy for example.

However, contract farming has had its disadvantages with Zimbabwe tobacco farmers. For example upon realising that they have produced only enough to service a loan from a contractor, with no surplus from which to enjoy profits, some farmers resort to selling to a different buyer (side marketing or extra-contractual marketing). FAO acknowledges that “…there are also potential disadvantages and risks associated with contract farming. If the terms of the contract are not respected by one of the contracting parties, then the affected party stands to lose.” [28] The implication therefore is that when Zimbabwean tobacco farmers are contracted by the Chinese, they (Zimbabweans) must be in a position to keep their end of the bargain and be committed to fulfilling the contract.

Problems may also arise from the contractor’s side. A company may refuse to buy tobacco at the agreed prices. Little and Watts argue that contract farming;

… is essentially an agreement between unequal parties: companies, government bodies on the one hand and economically weaker farmers on the other. Critics of contract farming tend to emphasise the inequality of the relationship and the stronger position of sponsors with respect to that of growers. Contract farming is viewed as essentially benefiting sponsors by enabling them to obtain cheap labour and to transfer risks to growers.[29]

Other problems include the delay of contractors to disburse inputs to the farmers which implies their farming season gets offset and risks not obtaining the required quantity or quality of tobacco yields which in turn implies they risk not realising a surplus profit or are unable to repay loans from contractors. The Management at a local tobacco auction floor in Harare indicated in an interview with this researcher that a challenge arises under contract farming when farmers side-market their crop and do not sell it in accordance with the terms of the contract to the contractor. This raises problems of breach of contract. The Sunday Mail (October 2012 issue) reported some farmers in Hurungwe in the 2011/20102 season “… lost their agricultural equipment after failing to pay back what they owed contractors such as Golden Driven Investments (GDI). Debt-recovery exercises resulted in several tobacco farmers losing their farm equipment which was auctioned, some for a song.”[30] The above problems notwithstanding, the balance between advantages and disadvantages for both firms and farmers seems to be on the positive side. There is need for all concerned parties to timeously deliver their obligations as per contractual agreement.

III. Conclusion

From the above discussion, it emerges that China’s engagement in Zimbabwe tobacco farming has proved beneficial and has positive implications for Zimbabwe and her economy. While there are challenges and concerns raised regarding China’s engagement, to a greater extent Zimbabwe’s tobacco farmers have been able to carry out and improve production. If China is Zimbabwe’s largest market, it would be good for the latter to benefit from producing a crop to the former’s specifications and at the same time gaining agricultural skills.

The implications of contract tobacco farming are; farmers have improved access to local markets, assured markets and prices (lower risks), assured and often higher returns, enhanced farmer access to production inputs, mechanisation and transport services and extension advice, availability of loans, access to innovations and management of good agricultural practices in line with ever increasing compliance issues which are increasingly getting pertinent to international markets, access to small scale farmers to international markets. China’s support also implies that small-scale tobacco farmers can participate in the market economy.

Source of documents:Global Review

more details:

[①] Zimbabwe Ministry of Lands and Rural Resettlement, “Introduction,” http://www.lands.gov. zw/.

[②] W. Anseeuw, T. Kapuya, and D. Saruchera, Zimbabwe’s Agricultural Reconstruction: Present State, Ongoing Projects and Prospects for Reinvestment, Working Paper Series, No. 32, Development Bank of Southern Africa, Development Planning Division, 2012, p. 42.

[③] C. Sukume & E. Guveya, “Improving Input and Output Markets for Smallholder Farmers in Zimbabwe,” Unpublished Report, 2009.

[④] Food and Agriculture Organization of the United Nations, “Issues in the Global Tobacco Economy,” 2003, http://www.fao.org.

[⑤] Ibid.

[⑥] Solidar, “Economic Partnership Agreements,” 2012, http://www.solidar.org.

[⑦] Cai Bing, “Reviewing the Industry for Sustainable Growth,” Tobacco Industry and Marketing Board National Tobacco Workshop, October 27-28, 2011.

[⑧] S. Schwersensky, “Harare’s ‘Look East’ Policy Now Focuses on China,” in G. Pere ed., China in Africa, A Mercantilist Predator or Partner in Development? Johannesburg: Institute of Global Dialogue, 2007, pp. 15-23.

[⑨] The Zimbabwe Herald, “1000 More Tractors Expected From China,” AllAfrica, November 9, 2010, http://allafrica.com/stories/200711020023.html.

[⑩] O. Mathawa, “China and Zimbabwe: Is There a Future?” Africa Files, November 22, 2007, http://www.africafiles.org/article.asp?ID=16426.

[11] E. Chikwati, “Flue-cured Tobacco Exports Earn US$95m,” The Herald (Zimbabwe), June 7, 2012, p. 5.

[12] Sukume & Guveya, “Improving Input and Output Markets for Smallholder Farmers in Zimbabwe”.

[13] Food and Agriculture Organization of the United Nations, “Issues in the Global Tobacco Economy”.

[14] TIMB Annual Statistics Report, 2011, Harare: TIMB, 2011, p. 5.

[15] Cai Bing, “Reviewing the Industry for Sustainable Growth”.

[16] Dr. G. Gono, “2012 Mid-Term Fiscal Policy Statement,” Zimbabwe Ministry of Finance, July 20, 2012, www.zimtreasurey.gov.zw.

[17] Food and Agriculture Organization of the United Nations, “Issues in the Global Tobacco Economy”.

[18] C. Eaton and A. Shepherd, “Contract Farming: Partnerships for Growth,” FAO Agricultural Services Bulletin, No. 145, 2001, http://www.fao.org.

[19] “Chinese Delegation Eyes Manicaland,” The Herald, May 8, 2011.

[20] C. Manyeruke, “An Exploratory Evaluation of China- Zimbabwe Investments and Trade Relations,” Sacha Journals, Vol. 1, No. 2, 2011, p. 99, http://www.sachajournals.com.

[21] P. Dicken, Global shift: Industrial Change in a Turbulent World, London, Paul Chapman, University of Manchester,1986:363.

[22] Eaton and A. Shepherd, “Contract Farming: Partnerships for Growth,” p. 13.

[23] “Zimbabwe Tobacco Farmers Hail Support from Chinese Firm,” CFM News, 2012, http://www.capitalfm.co.ke.

[24] “Zimbabwe Tobacco Selling Season Opens with Strong Output, Firm Prices,” Commercial Farmers Union, 2012, http://www.cfuzim.org.

[25] Eaton and A. Shepherd, “Contract Farming: Partnerships for Growth,” p. 14.

[26] Ibid.

[27] Manyeruke, “An Exploratory Evaluation of China- Zimbabwe Investments and Trade Relations,” p. 104.

[28] Food and Agriculture Organization of the United Nations, “Issues in the Global Tobacco Economy”.

[29] Peter D. Little and M. Watts eds., Living under Contract: Contract Farming and Agrarian Transformation in Sub-Saharan Africa, Wisconsin: University of Wisconsin Press, 1994.

[30] N. Pito, “Contract Farmers Sing the Blues,” The Sunday Mail, October 7, 2012, p. 4.