- China’s Foreign Policy under Presid...

- Seeking for the International Relat...

- The Contexts of and Roads towards t...

- Three Features in China’s Diplomati...

- The Green Ladder & the Energy Leade...

- Building a more equitable, secure f...

- Lu Chuanying interviewed by SCMP on...

- If America exits the Paris Accord, ...

- The Dream of the 21st Century Calip...

- How 1% Could Derail the Paris Clima...

- The Establishment of the Informal M...

- Opportunities and Challenges of Joi...

- Evolution of the Global Climate Gov...

- The Energy-Water-Food Nexus and I...

- Sino-Africa Relationship: Moving to...

- The Energy-Water-Food Nexus and Its...

- Arctic Shipping and China’s Shippin...

- China-India Energy Policy in the Mi...

- Comparison and Analysis of CO2 Emis...

- China’s Role in the Transition to A...

- Leading the Global Race to Zero Emi...

- China's Global Strategy(2013-2023)

- Co-exploring and Co-evolving:Constr...

- 2013 Annual report

- The Future of U.S.-China Relations ...

- “The Middle East at the Strategic C...

- 2014 Annual report

- Rebalancing Global Economic Governa...

- Exploring Avenues for China-U.S. Co...

- A CIVIL PERSPECTIVE ON CHINA'S AID ...

In the following, we shall take a closer look at the current state of U.S. defense innovation, and the reasons for its crossroads. Finally, we shall examine the state of Chinese defense innovation relative to its counterpart in the U.S.

I. Current U.S. Defense Innovation

Since World War II, U.S. defense R&D expenditures have been the highest among the major advanced economies. It was not until the late 1970s that the combined military spending of Germany, France, the UK and Japan exceeded that of the U.S. Ironically, today their share is smaller than that of the U.S., again as Europe has reduced its role in defense in favor of its generous welfare systems.

Despite America’s 60 years of leadership in defense innovation, this position is evolving.

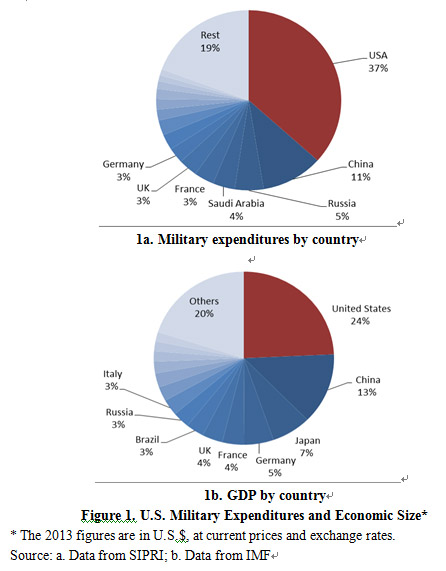

1.1 U.S. Military R&D Expenditures in International Perspective

In 2013, global military expenditure exceeded $1.7 trillion. U.S. military spending exceeded those of the next nine nations’ military expenditures together (China, Russia, Saudi Arabia, France, the UK, Germany, Japan, India, and South Korea) (Figure 1a).[①] U.S. military expenditures accounted for 37% of all such expenditures globally, even though American GDP is only 24% of the world economy (Figure 1b). Due to the continued sovereign debt crises, military spending is falling in the West—North America, Western Europe, and Oceania—but increasing in other regions.

In 2013, U.S. military spending fell by 7.8%, to $640 billion as Congress sought to reduce the budget deficit. However, neither the pre-sequestration cost-cutting proposals nor the automatic spending cuts themselves effectively address the need for a robust U.S. defense R&D regime going forward.

While defense is a significant objective of government R&D funding in most major advanced economies, its share varies widely. In the United States it was 57% of the federal R&D support in 2011; more than three times as much as in South Korea and the UK and eight times more than in France, Germany, or Japan, respectively.[②] As a share of GDP U.S. government R&D expenditures on defense are nine times that of China, Germany, or Japan; and 14 times more than the European Union nations. In contrast, the U.S. invests 40% less on non-defense R&D than do the EU nations.[③]

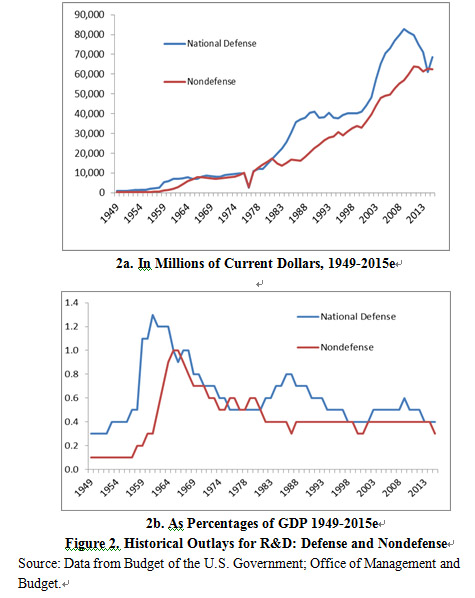

1.2 Evolution of U.S. Defense R&D

Through the Cold War, defense R&D dominated the federal R&D budget. Indeed, its share fell below 50% of the total R&D obligations in just three years. In 1960, defense research accounted for 80% of federal R&D funds. Its decline converged with the growth of the NASA space program, and the drawdown after Vietnam. Hovering around 50% until the early 1980s, it was boosted dramatically by the Reagan-era rearmament. By the mid-80s, the relative size of the defense R&D was more than twice as large as nondefense. As the Cold War faded at the end of the 1980s, the share of the defense R&D shrank back to just over half. However, things changed again after September 11, 2001, when national defense R&D expenditures rapidly increased, peaking in 2009. During the Great Recession, defense R&D has fallen significantly, but it will begin to climb relative to nondefense R&D in 2014 as the latter will be cut significantly (Figure 2a, 2b).

1.3 Key Defense R&D Actors

Of total federal obligations for R&D, more than half are accounted by the Department of Defense (DOD). The lion’s share of the rest can be attributed to the Department of Health and Human Services (HHS), Department of Energy (DOE), and NASA.

Moreover, the composition of federal obligations for defense R&D differs substantially from that in the civilian sector. In DOD defense R&D the bulk of R&D expenditures (81%) goes to development, particularly to advanced technology development - weapons systems, construction, prototypes, etc. - , whereas applied research accounts for less than a tenth, and basic research is barely 3%. In nondefense R&D, development accounts for just 15%, whereas basic and applied research account for 45% and 40%, respectively.

R&D directed at national defense objectives is supported primarily by the Department of Defense but it also includes R&D by the Department of Energy and, to a lesser degree, some other agencies. In terms of defense R&D performers, there are three main groups: federal laboratories, university-affiliated research centers (UARCs), and defense contractors. National defense represented about 58% of the total budget authority for R&D in fiscal 2011.

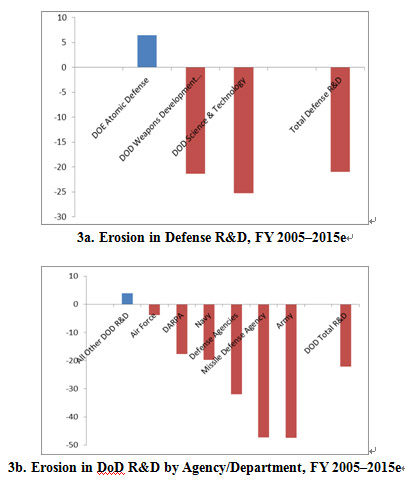

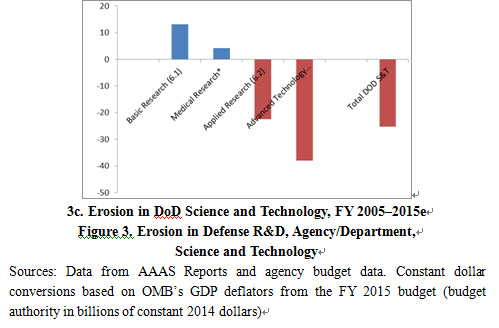

Defense R&D focuses on three main areas: DOD weapons development, DOD science & technology, and DOE atomic defense. Between 2005 and 2015, defense R&D, R&D by agency/department or science and technology are expected to decline significantly. By 2015, DOD expenditures for weapons development are expected to decrease to $52.6 billion (over 75% of the total defense R&D), and DOD science and technology to $12 billion (17%), while DOE atomic defense will rise to $5 billion (8%). In other words, between 2005 and 2015 (in inflation-adjusted terms), total defense R&D will have contracted by 21%. In the same time period, DOD weapons development and DOD science and technology will have contracted by 21% and 25%, respectively, whereas DOE atomic defense will have increased by 6% (Figure 3a).

Based on DOD R&D by agency or department – that is, Army, Navy, Air Force, Defense Agencies (Missile Defense Agency, DARPA) - the Air Force (36% of expected DOD total R&D in 2015) and Navy (25%) have remained dominant. Between 2005 and 2015, the Army, Missile Defense Agency and DARPA each have had a minor role in DOD total R&D (less than 10% by 2015). Through that decade, DOD total R&D shrank by 22%. The decline has been most dramatic in Army and missile defense (over -47% each), while both the Navy and DARPA suffered substantial decline (-20% and -18%, respectively); even the Air Force was no longer immune to decline (-4%) (Figure 3b).

Looking at the role of DOD science and technology between 2005 and 2015, the total is expected to decline from $16 billion to $12 billion. Advanced technology development is likely to contract by 38% to $5 billion by 2015. Meanwhile, applied research will decline to $4.4 billion (-23%), whereas basic research will climb to $2 billion (13%). In brief, total DOD science and technology is likely to contract by 25% from 2005 to 2015. These allocations peaked at $17 billion already in 1993, when advanced technology development accounted for 56% of the total. In 2015, the total will be a third less, while the share of advanced technology development will be 41% of the total (Figure 3c).

1.4 Top Defense Contractors

Defense R&D is also conducted by private sector defense contractors that build and maintain weapons systems. Today, most government contractors, including defense contractors, are coping with budget cuts, contract delays and uncertainty. The U.S. defense sector has been restructured three times after the Cold War. Today, after the sequestration in 2013, defense firms find themselves in a still new structural environment.

In terms of the number of companies, the U.S. defense industry is fragmented, with almost 2,700 companies operating across nine program-level sectors ranging from aircraft and space systems to light arms, ground vehicles, and services. Large companies are predominant, with 6% of them employing over 70% of the defense workforce. The aircraft sector is the largest and one of the few with both civilian and defense interests. Further, the front end of the supply chain is controlled by 10% of players that capture 43% of revenues.[④]

Among all government contractors, the top-10 companies account for $131 billion, or 29% of all contracts. Almost all are defense contractors, which also operate in non-defense industries, as evidenced by the industry leaders:

•the $46 billion Lockheed Martin Corp., which operates in aerospace, defense, security, and advanced technology

•the $87 billion Boeing, which designs, manufactures, and sells fixed-wing aircraft, rotorcraft, rockets, and satellites

•the $32 billion General Dynamics, an aerospace and defense company that is the world’s fifth-largest defense contractor

•the $25 billion Raytheon, a major defense contractor that manufactures weapons, and military and commercial electronics

•the $25 billion Northrop Grunman, a global aerospace and defense technology company that is the fourth-largest defense contractor

As the U.S. military is shifting its focus from hardware – metal and mechanics to unmanned vehicles, drones and smart bombs – software has become a critical piece of weaponry. Consequently, military capabilities must be extended to develop and maintain these complex architectures. Indeed, when measured by source lines of code (SLOC) created or modified by software developers, the amount of code in modern war-fighting systems has exploded over the past decade (Figure 4)

After the 9/11 terrorist attacks, federal and corporate spending into security has soared. Worldwide security software revenue alone totaled $19.9 billion in 2013, according to research firm Gartner. It is contributing to the democratization of security threats, driven by malicious software and infrastructure that can be used to launch advanced targeted attacks. The worldwide security technology and services market was estimated at $67 billion in 2013.[⑤]

Ever since the defense industrial base has become more focused on IT, the federal government has sought to engage in stronger partnerships with non-defense firms. That’s what happened amidst the late 1990s technology revolution, which led to In-Q-Tel (IQT), a CIA-backed technology incubator, which was created “to leverage technology developed elsewhere. In the past 15 years, IQT has backed startups later acquired by Google, Oracle, IBM, Lockheed, and other leading US technology giants and defense contractors. Over time, IQT has invested in over 180 portfolio companies and claims to have leveraged more than $3.9 billion in private-sector funds.[⑥] IQT should be seen in its context, however. In the United States, there are some 900 venture capital firms, which have $200 billion of venture capital under management, which translates to an average of $240 billion per firm.[⑦]

II. Defense Innovation at the Crossroads

After the eclipse of the Cold War, America has gradually shifted resources from Pentagon-led innovation toward mass consumer markets, especially in health care. What has been perhaps both surprising and unexpected is the subsequent drastic erosion of innovation. U.S. defense, especially as it relates to innovation, now faces key challenges.

2.1 Sequestration and Limited Budgets

Bipartisan recognition has been growing about the unsustainability of the current level of defense spending—about $700 billion per year—especially in view of the large U.S. budget deficits and unwillingness of the dominant political parties to reform the entitlement systems, even with the growing challenge of an aging population. True, the Obama administration has made a variety of proposals to reduce the defense budget, including cuts to big-ticket weapons programs like the F-22 and the F-35 Joint Strike Fighter. Moreover, the proposals would also cut defense R&D.[⑧] The Pentagon has expressed concern that the continued pinch on R&D could threaten U.S. technology superiority and harm the country’s industrial base. In addition, these cuts will reduce overall U.S. economic growth and global competitiveness. The projected decline in R&D will reduce U.S. GDP by at least $203 billion and up to $860 billion over 2013-21, depending upon the pre-sequestration baseline.[⑨]

2.2 Decline of the Industrial Base: The ICT Sector

Over the last decade and a half, U.S. manufacturing capabilities have been significantly reduced, in large part because of the rise of large emerging economies. Today, information and communication technology (ICT) has a central role in the civilian and defense markets. industrial activities took off in Silicon Valley in the 1970s and 1980s, the old ICT ecosystem shifted from its old vertical structure, in which one company controlled all value-chain activities from chips and hardware to software and sales, to the new horizontal structure that had multiple firms competing in different stages of the value networks, horizontal chips, operating systems, hardware, and software. The horizontal structure was initially dominated by U.S.-based firms. As the Internet revolution took off in the late 1990s, followed by mobile communications and social media in the 2000s, disruptive innovation ensured strategic space for new entrants at different levels, from U.S.-based ICT conglomerates (e.g., Google, Facebook, Apple) to their Korean counterparts (e.g., Samsung, LG).[⑩] At the same time, the globalization of the ICT industry gave rise to new ICT equipment makers and software challengers in China (e.g., Lenovo, Huawei, Tencent, Baidu) and new outsourcing service giants in India (e.g., Infosys, Wipro, Tata).[11] As suppliers have migrated to Asia, old U.S. industry giants have been broken up and acquired by U.S. and foreign rivals. By the early 2010s, Apple still excelled in smartphones, but without any production of its own.

Today, no ICT value system is controlled by a single company operating in a single nation.

2.3 Bias for Short-Term Policies

In addition to cost pressures, U.S. defense is coping with challenges relating to changes in the focus on R&D that favor near term development at the expense of long-term innovation. The technology race with the Soviet Union led to the 1958 launch of the Defense Advanced Research Projects Agency (DARPA), which was initially mandated to invest in high-risk, high-payoff research. By leveraging its linkages with the DoD, it could give a push to innovations.[12] However, the “new DARPA,” in focusing on bridging the gap from invention to innovation, may leave the U.S. technology pipeline without new sources.[13]

After World War II, it was initially taken for granted that defense-related R&D and military procurement would result in substantial spin-offs (from military applications to civilian usage) of technology. The spin-off paradigm prevailed as long as U.S. technology development enjoyed superiority in cutting-edge technology and defense markets until the eclipse of the Cold War.[14] In the early 1980s, the huge Reagan-era rearmament boosted the nation’s defense sector significantly, giving rise to the idea of the dual-use technology with both military and commercial dimensions. As a result, the spin-off was augmented with the spin-on (from civilian to military applications).[15] On the one hand, the new paradigm became the tacit way to cope with rising costs after the Cold War. On the other hand, it reflected the industry’s transformation, from concentrated government markets to mass consumer markets.

In this new environment, government policies no longer could shape the entire industry environment as in the past. Nonetheless, smart government policies continue to have potential to influence emerging industries.

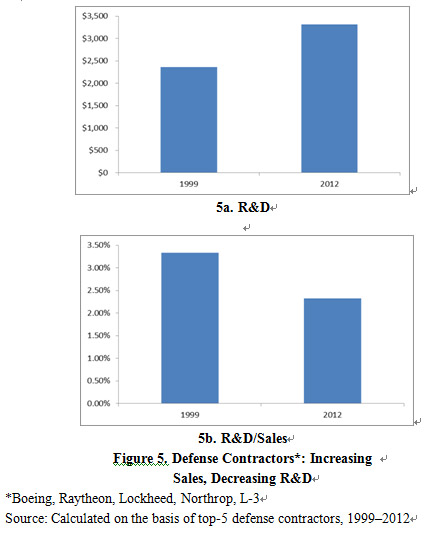

2.4 Erosion of Domestic Innovation

Today, domestic defense innovation is eroding. As the threat of the Soviet Union diminished, the “competitive stimulation” that had fueled military R&D during the Cold War era ebbed—until the threat of terrorism seemed to fill the vacuum. After September 11, 2001, defense and security expenditures soared for a decade. But these increases have not been reflected in R&D investments. In the past 14 years, R&D spending by the five largest U.S. defense contractors - Boeing’s defense unit, L-3 Communications, Lockheed Martin, Northrop Grumman, and Raytheon – has grown some 40 percent to $3.3 billion in absolute terms (Figure 5a). But, in relative terms, it has plunged from 3.3 percent of sales to 2.3 percent. While each contractor used a different strategy—from Lockheed’s dramatic R&D cuts to Boeing’s substantial R&D increases—the aggregate effect was the same (Figure 5b).[16]

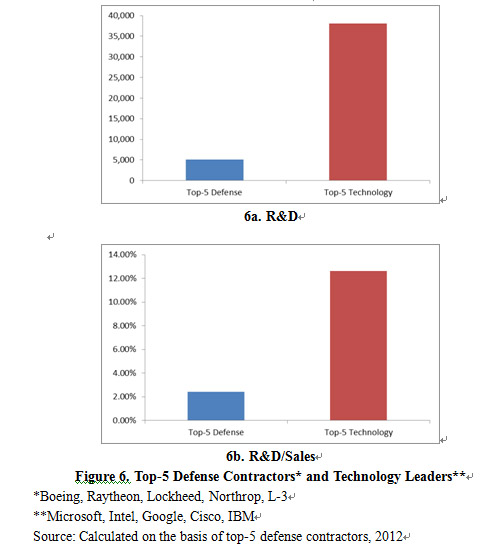

The decline of defense contractors’ R&D ratio looks even worse relative to the technology sector. In fact, a huge discrepancy exists between what the defense leaders and technology leaders are spending on R&D. In 2012, the five largest defense companies spent a total of $5.1 billion on R&D projects. During the same period, the leading technology giants—Microsoft, Intel, Google, Cisco, and IBM—invested almost $38 billion in R&D. With R&D intensity (R&D/sales), the discrepancy is equally evident. In 2013, this ratio varied around 1.3% to 3.6% among the five large defense companies. In 2013, the technology giants’ (Intel, Microsoft, Google, Cisco Systems, and IBM) corresponding ratio varied from around 19% to 5.3%. The technology giants invested in R&D 4–6 times more than America’s leading defense contractors (Figure 6).

In the Cold War era, the primary defense customer was the DoD. Today, it has been augmented by the global consumer marketplace. Unlike technology giants, defense contractors must serve two masters as they operate in both defense and consumer markets. In the past, defense giants could count on the government to fund much of their weapons system research, but that arrangement has been crumbling, in large part because of budget pressures and the prioritization of acquiring current weapons systems rather than developing the next ones.

2.5 Rise of Foreign Competition

In the past, the leaders of the global defense sector were primarily located in the major advanced economies in the West. Today, new challengers may not offer the world’s best technology, but cost-efficient technology may suffice in the international arms market. In this regard, the recent success of China’s unmanned aviation exports, including Yilong by Aviation Industry Corp., is only a foretaste of the future.

U.S. defense R&D seeks to respond to challenges, including cost-efficient foreign competition. Recently, the Air Force released an outline for its 30-year strategy, highlighting the technologies it plans to target. Some of the more promising technologies include hypersonics, nanotechnology, directed energy, unmanned systems, and autonomous systems.[17] Relying on “directed energy,” the Air Force will attempt to integrate lasers as a legitimate weapon. However, it is increasingly difficult for the U.S. to dominate and control the value chains that generate such weapons.

What these emerging threats represent is “cost innovation” but also technology innovation as emerging and transitional economies get better. The changes are reflected in the international arms market. In the past decade, America led the world in arms exports. But in 2013, Russia’s weapons exports surpassed those of the United States.[18] Many developing nations cannot afford expensive, high-quality defense products and services. So they opt for affordable, almost-world-class offerings.

III. Defense R&D in China Relative to the United States

In China, national defense has been an integral part of economic reforms and opening-up policies since the late 1970s, when Deng Xiaoping enacted the Four Modernizations. As first set forth by Zhou Enlai in the early 1960s, these modernizations initially sought to strengthen agriculture, industry, science and technology, as well as national defense. Despite strong growth rates, both defense expenditures and defense R&D in China remain significantly behind those of the U.S. Nevertheless, catching up is a matter of time. In the coming years, China’s changing growth model is likely to accelerate defense R&D, despite decelerating macro growth. In the process, Chinese defense innovation is likely to grow more integrated with the civilian economy.

3.1 Defense Expenditures in China: About 30% Relative to the U.S. – But Growing Rapidly

According to SIPRI[19], U.S. military spending amounted to $640 billion in 2013, whereas that of China was about $188 billion; less than 30% relative to U.S. spending. As we have seen, the U.S. represents 24% of the world economy, but its military expenditures are 37% of the world total. In the case of China, these figures are 13% and 11%, respectively (see Figure 1). In other words, U.S. military expenditures are about 50% higher than its role in the world economy would suggest. In contrast, China’s corresponding figure is over 15% lower than its share of the global economy would indicate.

In the past decade (2004-2013), U.S. expenditures have increased 12%, whereas those of China by 170%. Nevertheless, U.S. military expenditures remain over three times higher than those by China on annual basis, whereas China’s defense spending has grown 14 times faster than that of the U.S. in the past decade. These figures must be set in the context of the broader economy, however. In the U.S. military expenditures represent 3.8% of the GDP; in China, the corresponding figure is about 2.0%. Despite its slower growth, the U.S. continues to invest into defense twice as much as China annually.

In brief, China’s defense spending has grown rapidly, along with its parallel military modernization. However, the latter reflects the mainland’s rapid economic growth. Military modernization has been subject to national economic development.

3.2 Defense R&D in China: Estimated 15% Relative to the U.S. – But Growing Rapidly

In the aftermath of the global financial crisis in 2008/9, global R&D has grown more slowly than in prior years. This slowdown can be attributed primarily to the ailing Eurozone, the lingering U.S. recovery, Japan reform agenda, and China’s decelerating growth. These four, in turn, have affected global R&D. In relative terms, U.S. growth prospects are more promising than those in Europe or Japan, but in view of innovation funding the deceleration is quite clear in all three.[20] But that is not the case with China. While R&D budgets have been slashed in the US and particularly in Europe and Japan, the new Chinese reform agenda seeks to accelerate the role of innovation spending, even amid decelerating growth.[21]

R&D figures tend to be intimately aligned with GDP and economic outlook. In the aftermath of the global crisis in 2008/9, U.S. share of global R&D has declined from 34% to 31%, whereas that of China has almost doubled from 10% to 18%. At the same time, China’s total R&D investments have grown to more than 60% those of the U.S.[22] China is likely to surpass Europe in total R&D spending by the end of the 2010s and the U.S. by the early 2020s.

In the past, the international assumption was that some 5% of overall defense spending in China was devoted to military R&D. More recently, various sources in the West have argued that this figure to be “closer to 8 to 10%,” making it the second in the world in military R&D. Based on the higher figure and the stated Chinese defense budget for 2013, total Chinese military R&D would amount to about $9.4 to $11.7 billion. In the U.S., the DoD’s 2014 budget includes $73 billion for total RDT&E in 2013, with a request for over $67 billion in 2014. In other words, even higher estimates of Chinese military research, development, and acquisition (RDA) spending would be about 13-16% relative to that of the U.S.[23]

3.3 China’s Growth Model and Chinese Defense R&D

There is a broad and deep tie between China’s economic prospects and its civilian and military R&D. In the past, Chinese military R&D has been driven by relatively high investments supported by the country’s rapid growth. Today, the challenge is that Chinese military R&D must be driven by higher innovation that should be sustained by growth and reforms.

From the 1980s to the 2000s, Chinese defense economy relied mainly on imitation. Since the launch of the development plan in 2006, the global crisis in 2008-9 and the leadership transition in 2012-13, China’s move toward indigenous innovation has accelerated. China’s indigenous innovation reflects a huge and complex development plan to turn the economy into a technology powerhouse by 2020 and a global leader by 2050.[24] For all practical purposes, the shift is also reflected by the changing direction of net foreign direct investment (FDI) flows. Today, China’s outbound investment flows exceed foreign direct investment into the country.

According to U.S. observers, China’s defense industry has benefited from integration with its expanding civilian economy and science and technology sectors, particularly sectors with access to foreign technology. Examples of technologies include advanced aviation and aerospace (hot section technologies, avionics, and flight controls), source code, traveling wave tubes, night vision devices, monolithic microwave integrated circuits, and information and cyber technologies.[25]

What is more important in the long run is the shift from incremental and sustaining innovation toward architectural and disruptive innovation. Imitative innovation is exemplified by the development of nuclear weapons and strategic missiles in the 1960s and 1970s, and perhaps the development of long-range precision ballistic missile capabilities in the 1990s. Until recently, China’s defense innovation relied on selective targeting of a few critical areas for accelerated development. In the shift toward architectural and disruptive innovation, the key role will belong to defense electronics, aviation, shipbuilding and certain segments of the space industries.[26]

That shift is also driven by China’s efforts to enlist the private sector to accelerate the rise of its defense contractors. The key areas of investment are expected to be fighter and multi-role aircraft, submarines, helicopter, naval vessels, and missile defense systems.[27] The efforts to accelerate the integration of state-owned defense contractors and private companies build on efforts to build on the success of military-inspired innovations that have already found their way into civilian life. For example, China Shipbuilding Industry Corp, one of the country’s largest defense-sector enterprises, which took a leading role in the construction of the first Chinese-built aircraft, now also produces commercial yachts. “About 30 percent of military and civilian inventions could cross over into each other’s markets,” said Cao Zhiheng, inspector of the ministry’s Military-Civilian Promotion Department.”[28]

If the current momentum in national innovation can be sustained, Chinese defense R&D is positioned to significantly reduce its technological gap with the world’s leading military powers by the early 2020s. Indeed, the defense authorities have set a target for all defense companies to spend at least 3% of their annual revenues on R&D by 2020 – which would exceed the current average of America’s largest defense contractors.

IV. Epilogue

In brief, the state of U.S. defense innovation, despite its resilience and superiority worldwide, exhibits structural erosion and relative decline. American military remains superior in terms of its size and global engagement, however.

This scenario is based on U.S. economic conditions that have significantly improved since the aftermath of the global crisis in the early 2010s. It is predicated on a steady course in the rest of the 2010s, with real GDP growth at 2-3 percent and inflation at 2-2.5 percent. It presumes a steady exit from several rounds of quantitative easing and a smooth hike of interest rates starting by mid-2015. Under this scenario, sequestration would prevail and non-strategic, across-the-board cuts continue in the U.S. military and defense innovation.

In contrast, the state of Chinese defense innovation, which started from a very low base but, has grown rapidly, exhibits strong structural expansion.

This scenario is based on Chinese economic conditions feature significant deceleration since the global crisis. The scenario is also predicated on a steady course in the rest of the 2010s, with real GDP growth at 5-7 percent. Under this scenario, China would be at par with major advanced economies in defense innovation by the early 2020s.

Source of documents: Global Review

more details:

[①] SIPRI Military Expenditure Database, July 2014. .

[②] National Science Board, Science and Engineering Indicators 2014, Arlington VA: National. Science Foundation, 2014, p. 4-39. See also R. D. Atkinson et. al., The Global Innovation Policy Index, Information Technology and Innovation Foundation and the Kauffman Foundation, March 2012, Table 3-5, p. 44.

[③] Calculated on the basis of SIPRI Military Expenditure Database, July 2014; see also Atkinson, The Global Innovation Policy Index, p. 43.

[④] Data from A. T.. Kearney.

[⑤] “Gartner Says Worldwide Security Software Market Grew 4.9 percent in 2013,” Gartner.com, June 10, 2014.

[⑥] G. Tenet, At The Center Of The Storm: My Years at the CIA, New York, Harper Press, 1997, p. 26.

[⑦] National Venture Capital Association Yearbook (annual).

[⑧] S. Ghoshroy, “Restructuring defense R&D,” Bulletin of the Atomic Scientists, December 2011: 20.

[⑨] J. Hicks and R. D. Atkinson, “Eroding Our Foundation: Sequestration, R&D, Innovation and U.S. Economic Growth,” ITIF, September 2012, p. 1.

[⑩] See D. Steinbock, The Triumph and Erosion in American Media and Entertainment Industries, Westport, CT: Quorum, 1997; and D. Steinbock, The Birth of Internet Marketing Communications, Westport, CT: Quorum, 2000.

[11] On the changing ICT ecosystem, see D. Steinbock, “China as ICT Superpower,” China Business Review, March 2007; D. Steinbock, “The Mobile Revolution and China,” China Communications, Vol. 3, No. 2, April 2006; and D. Steinbock, “India and the Mobile Revolution,” Strategic Innovators (IIPM/India), October 2006.

[12] See P. Singer, Federally Supported Innovations: 22 Examples of Major Technology Advances that Stem from Federal Research Support, Washington, DC: Information Technology and Innovation Foundation, 2014.

[13] See E. R. H. Fuchs, “The Role of DARPA in Seeding and Encouraging New Technology Trajectories: Pre- and Post-Tony Tether in the New Innovation Ecosystem,” Working Paper, No. 1, Pittsburgh, PA: Industry Studies Association Working Paper Series, January 2009.

[14] On the spinoff paradigm and the early efforts to go beyond it, see John A. Alic et. al., Beyond Spinoff: Military and Commercial Technologies in a Changing World, Boston: Harvard Business School Press, 1992.

[15] See John A. Alic, Trillions for Military Technology: How the Pentagon Innovates and Why It Costs So Much, New York: Palgrave Macmillan, 2007, particularly Chapter 1.

[16] Industry executives argue that the Pentagon’s focus on purchasing low-cost products, especially the introduction of concepts like lowest price technically acceptable bid analysis, is encouraging companies to keep R&D spending low.

[17] USA Air Force, America’s Air Force: A Call to the Future, July 2014.

[18] SIPRI Arms Transfer Database, August 2014.

[19] SIPRI’s estimate is based on open sources (including the China Government Finance Yearbook) includes official figures or estimates for a number of other items in addition to the central and local defense budgets and the official budget of the People’s Liberation Army.

[20] D. Steinbock, The Challenges for America’s Defense Innovation, Information Technology & Innovation Foundation (USA), November 2014; D. Steinbock, The Erosion of U.S. Innovation, Information Technology & Innovation Foundation (USA), forthcoming 2014; D. Steinbock, U.S. Innovation and Entrepreneurship, Tekes, September 2014.

[21] The official government figures on Chinese R&D are often contested in the West where critics consider it likely that they are overstated. Nevertheless, the growth of Chinese R&D is significant. Furthermore, structural R&D trends may favor China in the coming years.

[22] Steinbock, The Erosion of the U.S. National Innovation System.

[23] These figures are based on estimates by The Military Balance (International Institute for Strategic Studies) and the series of US Department of Defense annual reports to Congress on the Chinese military.

[24] As outlined in the landmark document that launched the initiative, “The National Medium- and Long-Term Plan for the Development of Science and Technology (2006-2020),” the initiative is characterized as the “grand blueprint of science and technology development” to bring about the “great renaissance of the Chinese nation.”

[25] See Military and Security Developments Involving the People’s Republic of China 2013, Annual Report to Congress, DOD, June 2014, p. 13.

[26] On international views regarding China’s leading defense innovation sectors, see the publications of SIPRI and the SITC policy briefs by the Institute of Global Conflict and Cooperation at University of California, among others.

[27] The Future of the Chinese Defense Industry, Strategic Defense Intelligence, July 2014.

[28] According to a recent report by the Ministry of Industry and Information Technology, 26 bases for civil and military industrial integration have been established, and 2 billion yuan ($327 million) has been invested in the project. See Peng Yining, “From Military Model to Market Forces,” China Daily, October 28, 2014.